The New Frontier: Where the Cash Flows North

A Deep Dive into the Investment DNA of Billings, Fargo, Rapid City, and Sioux Falls

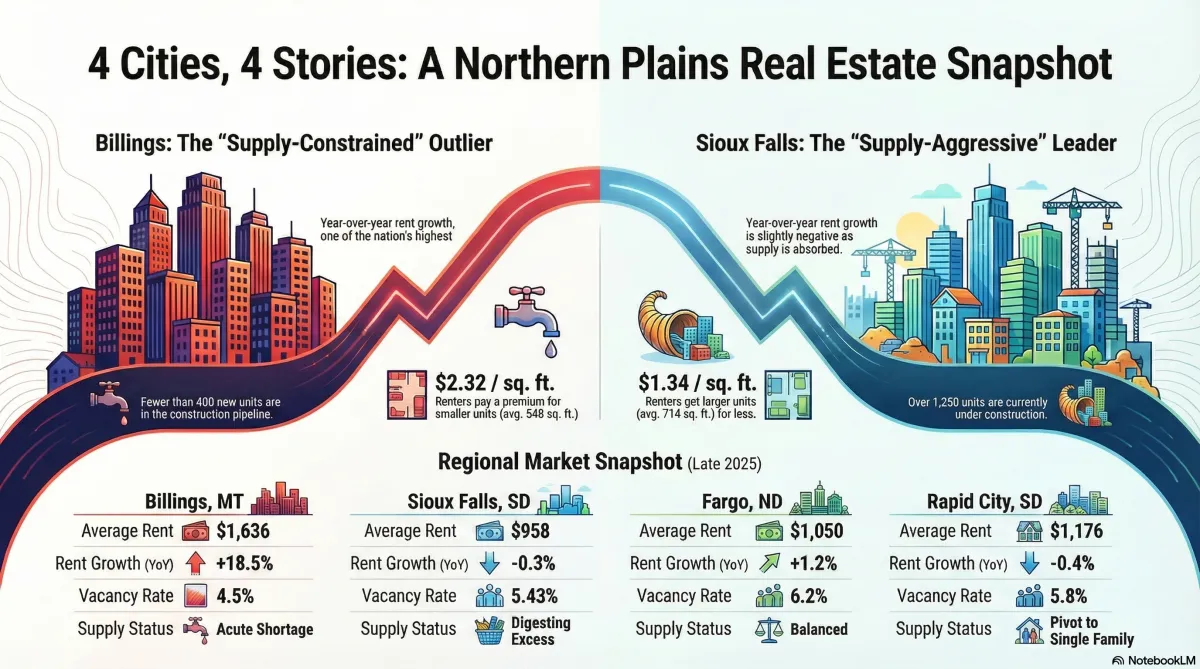

While national headlines focus on major coastal markets, a complex and compelling real estate story is unfolding in the Northern Plains. In cities once overlooked by institutional capital, powerful demographic and economic forces are creating distinct opportunities for savvy investors.

This analysis dissects the data-driven narrative of four key markets: Billings, MT; Fargo, ND; Rapid City, SD; and Sioux Falls, SD. Our objective is to move beyond generic commentary and reveal four distinct investment theses for 2026 and beyond, based on a comprehensive review of market data as of December 2025.

The National Backdrop: A Market of Contradictions

The core theme of the national multifamily market in late 2025 is the "Great Disconnect"—a sharp divergence between the exceptional operational health of well-capitalized properties and the significant friction in the capital markets. Distress is not being driven by a lack of tenants, but by the rising cost of debt for over-leveraged owners.

Strong Operations: Publicly traded apartment REITs are reporting an impressive 17.3% Year-over-Year FFO (Funds From Operations) Growth, signaling that underlying rental businesses are highly profitable.

High Structural Pain: Despite strong operations, the national multifamily delinquency rate has nearly doubled year-over-year to 6.59%. This indicates that distress is interest-rate driven (floating-rate loans resetting) rather than occupancy-driven.

Cooling Rents: National rent growth has slowed to a modest 2.2% annually, and the national vacancy rate has ticked up to 7.1% as a wave of new supply delivered in 2024-2025 gets absorbed.

The Coming Supply Shock: While construction spending remains high on projects started in 2024, the pipeline for future development has thinned dramatically. The number of new permits issued for large-scale projects has dropped to 481,000, far below recent peaks, setting the stage for a significant supply shortage in 2027 and beyond.

The Tale of the Tape: A Four-Way Face-Off

This table provides a side-by-side comparison of the four markets, revealing stark differences in their fundamental metrics.

Market Deep Dive: The Four Contenders

Billings, MT: The King of the Hill

The Story: The Billings market is defined by one overwhelming reality: an "Acute Shortage" of housing. For years, construction has failed to keep pace with demand, creating a massive accumulated deficit of nearly 4,700 units. Unlike its regional peers that rode a national construction boom, Billings' pipeline has been stalled by higher local construction costs and a lack of large-scale institutional developers, creating this structural deficit. The 312 units currently under construction are a drop in the bucket. This imbalance creates an "Unfair Advantage" for existing landlords, giving them immense pricing power in a market where tenants have few, if any, alternative options.

By the Data:

Rent: The average rent of $1,636 represents a staggering 41% premium over the most affordable market in this analysis, Sioux Falls.

Rent Growth: Rent growth is an explosive 18.5% year-over-year, reflecting the extreme supply-demand imbalance.

Vacancy: The vacancy rate is a critically low 4.5%, well below the national average and indicative of a landlord's market.

The "Fixed Income" Risk: A key long-term risk is the market's high dependency ratio (58.5), reflecting a large and growing population of retirees. This creates a potential "rent wall," where a large segment of the tenant base on fixed incomes cannot absorb perpetual, aggressive rent hikes.

The Investor Playbook: The clear strategy is to target "Accessibility Rentals." Focus on developing or acquiring single-story duplexes or accessible 4-plexes. Target the "Budget Retiree" demographic in Billings Heights (Zip 59105), a quieter, more affordable area, and the "Old Guard Wealth" in The West End (Zips 59102/59106), where established, high-income households reside.

Sioux Falls, SD: The Family Factory

The Story: Sioux Falls is in a "Supply Digestion" phase. After a massive construction boom, the market is absorbing the 1,256 units still in the pipeline. In the short term, this creates a "Dogfight" for landlords, where concessions are necessary to attract tenants. However, the city's powerful long-term growth fundamentals—driven by a diverse economy in logistics, finance, and healthcare—are undeniable.

By the Data:

Rent: At $958, Sioux Falls offers the most affordable rent in the group, a 41% discount to the national average.

Rent Growth: Rents have seen a slight correction of -0.3% year-over-year as the market works through its new supply.

Vacancy: The vacancy rate is a healthy 5.43%. Impressively, this has been nearly halved from a peak of over 10% in January, demonstrating the market's robust absorption capacity.

The "Future Worker" Pipeline: The city's high Youth Dependency Ratio (32.1) is a powerful leading indicator. It signifies a growing population of young families, ensuring a deep and expanding tenant pool for years to come.

The Investor Playbook: The play is to target "Family" Rentals, not luxury studios. The data points towards a clear need for 3-bedroom units near schools. Focus acquisition and development efforts in West Sioux Falls (Zip 57106) to capture the wave of millennial families driving the city's growth.

Fargo, ND: The "Boring" Wealth Builder

The Story: Fargo is the "steady-eddie" of the Northern Plains. Its market is characterized by a "Balanced" supply pipeline and a remarkably stable, recession-resistant "knowledge economy" built on technology (Microsoft), education (NDSU), and healthcare. This creates a low-volatility environment for investors seeking predictable returns.

By the Data:

Rent: Rents are affordable at $1,050.

Rent Growth: Rent growth is a stable and sustainable 1.2% year-over-year.

Vacancy: The vacancy rate of 6.2% tracks closely with the national average, indicating a healthy equilibrium.

The "Demographic Dividend": Fargo's key advantage is its low dependency ratio (43.2), the best in the region. This means the city has a large base of working-age professionals with fewer dependents, translating directly to higher disposable income available for rent.

The Investor Playbook: The winning strategy is "Lifestyle" Rentals. Invest in Class A/B multifamily properties with modern amenities in South/West Fargo (Zip 58104). This area is the hub for the "New Money Millennial" tech and medical workers who are willing to pay a premium for convenience and quality of life.

Rapid City, SD: The Affordability Haven

The Story: After a significant apartment boom in 2024, Rapid City has pivoted its construction focus to single-family homes. This positions the rental market as a "safety" valve, attracting residents and workers fleeing higher-cost Mountain West states. It offers a stable, affordable alternative in a region where housing costs have soared.

By the Data:

Rent: The average rent of $1,176 is an affordable 28% below the national average.

Rent Growth: A slight negative correction of -0.4% year-over-year reflects the market normalizing after its recent supply delivery.

Vacancy: The vacancy rate is a moderate 5.8%.

Construction Focus: The current development pipeline is concentrated on Workforce/Suburban housing, catering to the core of the local economy.

The Investor Playbook: The opportunity in Rapid City is a strategic regional affordability play. With new large-scale multifamily construction on pause, existing workforce housing serves as a critical pressure release for residents and workers fleeing the high-cost markets of states like Colorado. The strategy is to acquire and maintain quality rental properties that offer a compelling and affordable alternative to homeownership for this steady stream of new arrivals.

The Final Verdict: Placing Your Bets for the Next Decade

Each market presents a distinct risk and reward profile. The best investment depends entirely on your strategic goals.

Investment Profile

Top Market

The Reason Why

Best for Immediate Cash Flow

Billings, MT

The acute supply shortage creates a "defensive moat," allowing for consistent, aggressive rent growth with minimal competition.

Best for Long-Term Growth

Sioux Falls, SD

The powerful combination of a diverse, high-growth economy (logistics, finance, healthcare) and a growing population of families will absorb current supply, leading to significant future rent appreciation.

Best for Safety & Stability

Fargo, ND

The recession-resistant "knowledge economy" and a demographic dividend of young professionals provide a low-volatility environment for steady, predictable returns.

Best for Regional Affordability Play

Rapid City, SD

As the city pivots away from large-scale multifamily construction, existing rentals serve as a critical safety valve for residents priced out of more expensive Mountain West markets, ensuring stable demand.

Conclusion: Know Your Market, Know Your Strategy

There is no single "best" market in the Northern Plains—only the market that best aligns with an investor's specific goals for risk, growth, and cash flow. The data reveals four clear paths. Whether an investor seeks the high-yield, high-anxiety play of Billings, the aggressive compounding potential of Sioux Falls, the steady wealth-building of Fargo, or the strategic affordability haven of Rapid City, the Northern Plains offers a compelling thesis for those willing to look beyond the headlines and follow the numbers.